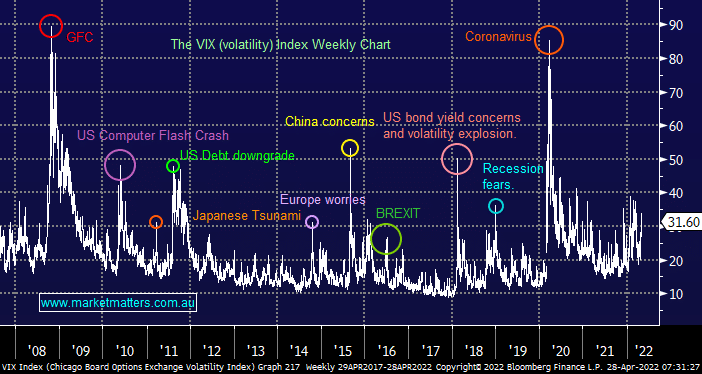

Global equities have experienced a sharp downturn over the last week following a worsening COVID picture in China, a month ago everybody was discussing the financial implications of Russia’s invasion of the Ukraine, today its hardly getting a mention. As we’ve said before markets have been rolling from one headwind to the next through 2022 but they are still fairly resilient albeit scary at times. The classic “Fear Gauge” or VIX as it’s called is nowhere near the panic levels we’ve witnessed at times over the last decade but that could easily be deemed as complacency because buying the dip has certainly proven the best value add over recent years.

MM started 2022 looking to migrate down the risk curve into strength and ideally new highs for the ASX, we’ve certainly started the journey but haven’t yet gone “all in” as the local index failed to pop to new highs this month, we will monitor closely moving forward if we believe such a rally remains likely this financial year but seasonally we are now entering a very average time for stocks i.e. “sell in May & go away” etc. Hence the question we ask ourselves is should we be further down the “risk off” curve when it comes to our portfolio construction or in other words should we hold more defensives and if so what – the markets clearly thought so this year dumping tech and buying the likes of utilities stocks, a trend which hasn’t been evident in over a decade.

Firstly a quick recap on what makes a defensive stock:

- A company that is positioned to deliver stable earnings whatever the macro-economic picture e.g. food, health care, electricity and water, simply things we always need.

On the sector level, investors usually turn to the Consumer Staples, Communications Services, Utilities and Healthcare stocks because in tough times we still need to eat, keep warm and healthy while a new TV can wait. If we do indeed see tough economic times for the reasons mentioned earlier as central banks start hiking rates to slow inflation cyclical stocks could easily struggle if the RBA, FED et al go too hard too fast, as they so often do.