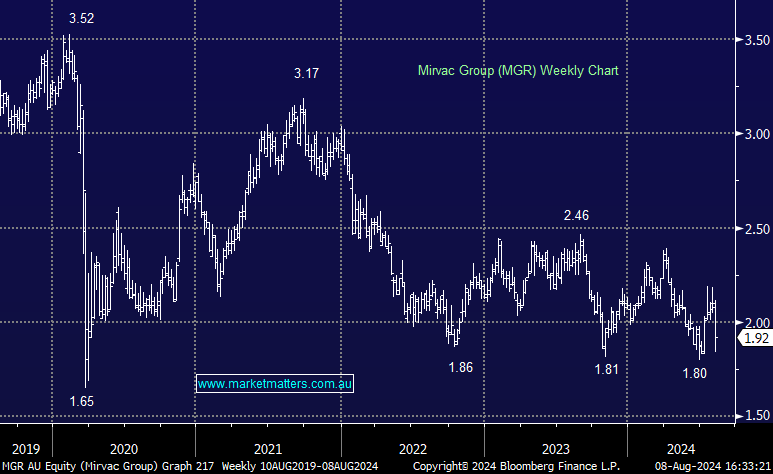

MGR -9%: Weaker FY25 guidance saw the shares hit today, however, we still see value in holding MGR in the Active Growth Portfolio.

- FY24 Operating EPS of 14c was at the lower end of their guidance range of 14-14.3c.

- Final distribution of 6cps was inline with expectations, taking FY payout to 10.5c.

- FY25 guidance for EPS of 12-12.3cps was 10% below consensus

- FY25 distribution guidance of 9cps was equally soft.

Lower development contributions and higher net interest costs are to blame, while gearing at 26.7% was down for the half, but still at the upper end of their target range of 20-30%.

- A disappointing update from MGR, though, it does not change our thesis, with the potential for upside around interest expense costs and asset sales.