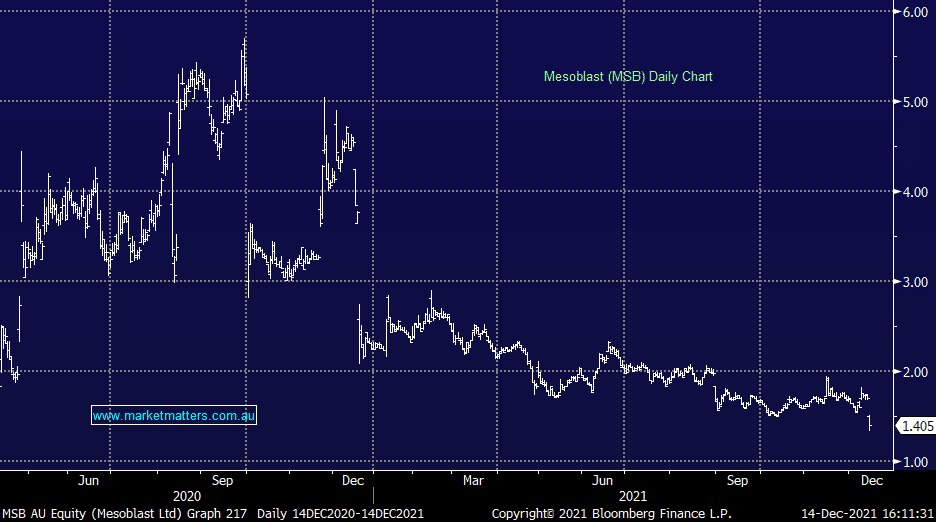

MSB -17%: crashed to 18 month lows today after Swiss healthcare giant Novartis walked from a deal around a treatment for COVID related respiratory issues. Novartis and Mesoblast penned a collaboration agreement last year which saw Novartis make an initial $US50m upfront payment with a $US25m equity stake. The deal could have been worth $US1.25b the remestemcel-L treatment was to achieve certain commercialisation targets and sales milestones but Novartis pulled the plug today, around 12 months after the initial day. Mesoblast remains confident the treatment is effective and trials have shown a fall in mortality rates in trials on COVID ARDS patients.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

Related Q&A

Is Mesoblast (MSB) a buy now?

Mesoblast Ltd (MSB)

Thoughts on A2Milk & Mesoblast

Genesis Minerals

We are bullish Dubber (DUB)!

Thoughts on MSB

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.