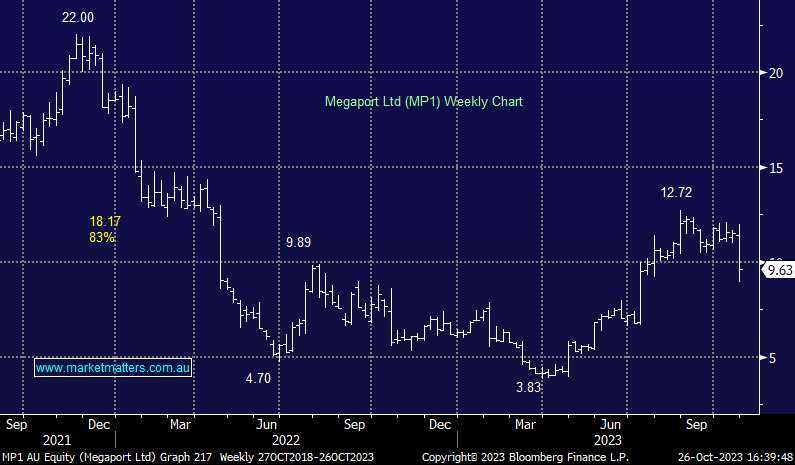

MP1 -16.33%: any sign of weakness in the Tech sector has been treated harshly recently, and connectivity company Megaport was no exception today despite maintaining FY24 guidance. The company hit record quarterly EBITDA of $15m which compares to the $1m EBITDA in 1Q23 and up 27% on the prior quarter. Cashflow was also positive at $5.6m however it was the slow growth in customer numbers that had the market concerned. Annualized Recurring Revenue (ARR) was up 6% QoQ, largely driven by a 5% benefit from FX, and Customer Ports was up just 1%. Cost control has improved the underlying business substantially in the last 6 months however stagnating the top line growth had the market concerned.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains neutral MP1

Add To Hit List

Related Q&A

MM’s view on WTC and MP1 please

Does MM like Megaport (MP1) into current weakness?

What are your current thoughts on Megaport (MP1)?

Is MP1 Megaport Ltd (MP1) presenting value?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

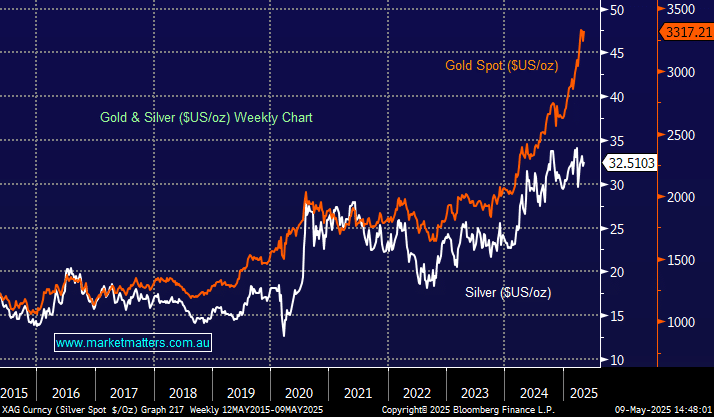

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.