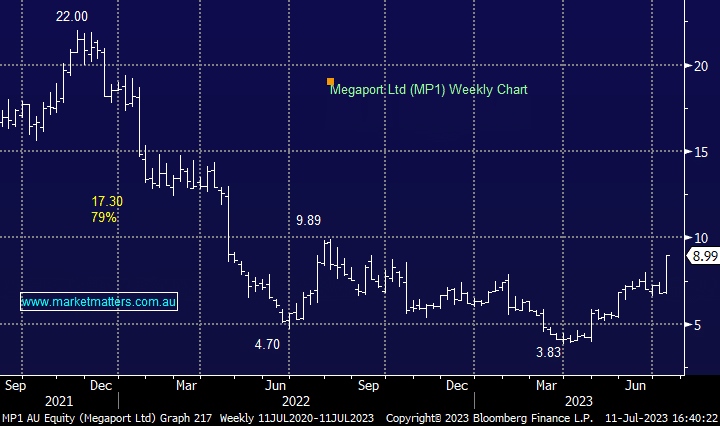

MP1 +33.78%: network connectivity business Megaport saw shares rocket to a 9-month high today on a small upgrade to FY23 earnings and a strong runway into FY24. The business went through an aggressive cost-cutting program in FY23 which looks to be bearing fruit earlier than thought under the guidance of a new CEO just 8 weeks into the role. Normalized EBITDA is now expected to be between $19-21m, up 17% at the midpoint while also confirming they were net cash positive in Q4 despite $2.6m of redundancy payments due. Given the progress, Megaport said it is likely to upgrade FY24 guidance (EBITDA of $41-46m) at their FY23 results next month, and they have cancelled an expensive $25m debt facility with HSBC. More than 6% of MP1 shares were held short-sold before the announcement also supporting the squeeze higher.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

MM is neutral MP1

Add To Hit List

Related Q&A

MM’s view on WTC and MP1 please

Does MM like Megaport (MP1) into current weakness?

What are your current thoughts on Megaport (MP1)?

Is MP1 Megaport Ltd (MP1) presenting value?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.