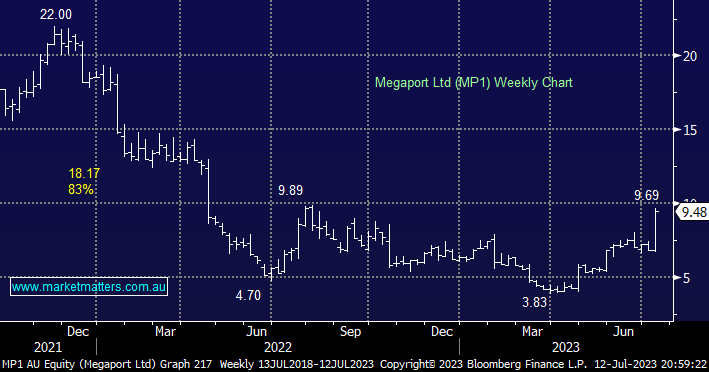

MP1 has already surged over +40% following the upgrade this week, the horse has clearly bolted from a risk-reward perspective but we still wouldn’t be fading its ascent towards $10.

- We like the direction MP1 is travelling after they delivered improved operating metrics and financial performance vs previous guidance.

A month ago UBS put together an excellent report titled ” What’s crowded in Australia?” with the following names front and centre:

Most crowded longs: ALS Ltd (ALQ), Northern Star (NST), Iluka (ILU), Brambles (BXB), Treasury Wine (TWE), Aristocrat (ALL), BlueScope (BSL), Steadfast (SDF), Altium (ALU) and Orica (ORI).

Most crowded shorts: REA Group (REA), Reece (REH), NextDC (NXT), Harvey Norman (HVN), Computershare (CPU), Westpac (WBC), Commonwealth Bank (CBA), Nine Entertainment (NEC), Mineral Resources (MIN) and National Australia Bank (NAB).

There’s clearly no great love for the banks at the moment but this morning we’ve looked at 3 names from the “crowded shorts” list that we haven’t visited of late in case we see a standout opportunity from a risk/reward perspective after witnessing how hard they can rally on good news – note, recently we have already purchased 3 unloved names looking for some “risk on” reversion as yields fall i.e. Lend Lease (LLC), Magellan (MFG) and Elders (ELD), just shame it wasn’t MP1.