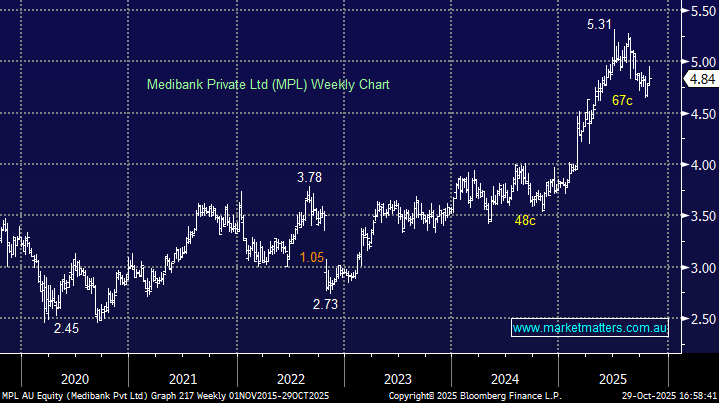

Insurance companies are traditional winers of higher interest rate environments but we must be conscious today of where they hold their funds with the Fed still cutting rates, albeit it at a slightly slower pace than expected at the start of the week. Health insurer MPL has enjoyed a solid year, enjoying some of the “Certainty Bid” after delivering solid earnings growth. We’re conscious that the stock is not cheap, trading on 20.6x FY26, slightly above its average valuation, although so is much of the market. The stocks 4% fully franked yield and stable earnings should help this health insurer outperform into 2026, especially as it holds funds, well over $1.1bn at the end of FY25, in local yield-bearing assets to offset future claims, hence it makes more money if the RBA doesn’t cut interest rates.

- We like insurers MPL and QBE as RBA and Fed aggressive rate cuts look increasingly less likely.