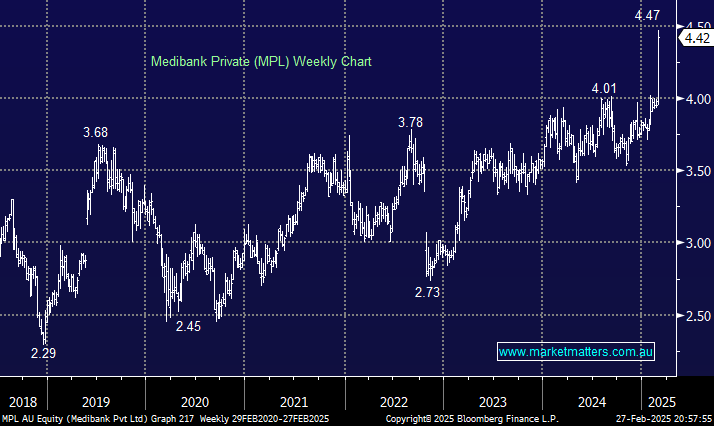

Thursday saw health insurer MPL soar +9.95% to a record high after reporting better first-half profits on more substantial margins in its health insurance business. This was all before the health minister approved the hike; MPL is set to increase prices by 4% on “April Fool’s Day.”

- Revenue of $4.27bn was up +6.8% YoY but slightly below the $4.29bn estimated.

- Underlying net profit after tax up 13.8% to $298.7 million, above estimates.

- An interim dividend of 7.8c was declared, up +8.3% YoY.

Overall, this is a solid result for MPL, which is in control of claims, with Private Health Insurance (PHI) margins up +0.5% above analyst estimates. However, like the trends in general insurance, we question whether or not this is “as good as it gets”.

- We like MPL as a defensive play, with a forecasted 4% fully franked yield over the next 12 months, though we’re reticent to chase it post a ~10% rally yesterday.