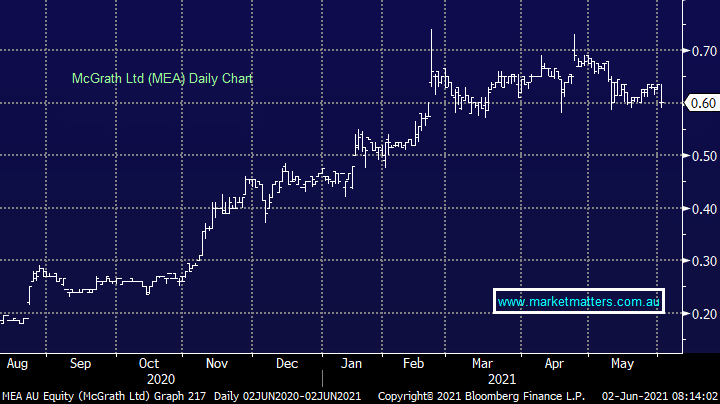

Most subscribers would be familiar with the real estate agency group McGrath (MEA). They IPO’d to big fanfare back in 2016 however the bubble soon burst with a number of downgrades and management issues saw the stock tumble from its $2.10 listing price to below 20c even before COVID took its toll. The rebound is gaining momentum though – McGrath have been certainly helped by a swift turnaround in the property market which saw them return to profitability in the first half of this year. They have no debt and more than $17m in cash at the half year result – plenty of flex to help grow and continue to take strategic positions in things like Oxygen Home Loans – a McGrath founded mortgage broking business. The company provided FY21 guidance for the first time in April, with EBITDA expected between $16.5-17.5m putting it on just ~5x EV/EBITDA and given the continuing property market commentary, this figure could be light on.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is interested in MEA ~60c

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

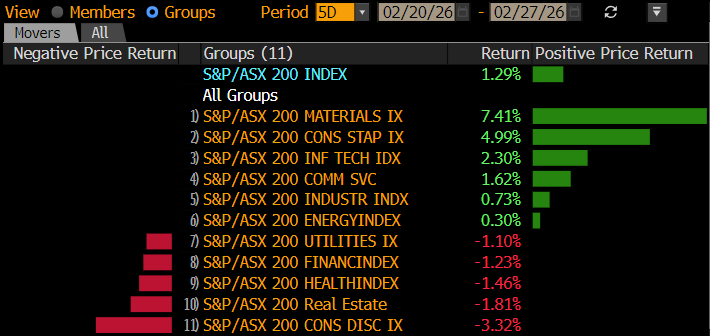

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.