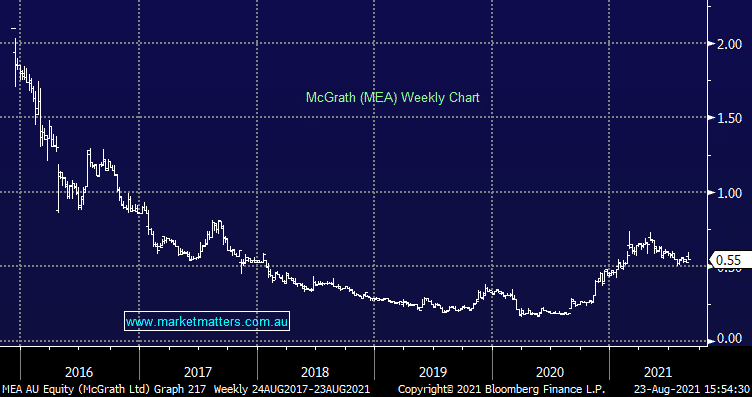

FY21 Results: The real-estate agent announced a 34% increase in revenue today taking it to $122.4m, NPAT of $19m and its first dividend since 2017 as strength in the property market filtered through to a good turnaround in earnings. After a tough few years, MEA now has a market capitalisation of $92m which against its NPAT for FY21 looks cheap (less than 5x earnings). As always, guidance key with the Chief Executive Eddie Law talking it up (although that’s standard for Sydney real-estate agents!!). “Our expectation was that the lockdown wasn’t going to be as extensive as it’s been, but amazingly, and I do say amazingly, the real estate sector has found a way to trade through COVID, and given the listings volume in evidence and given forward option bookings, there’s nothing to suggest at the moment that’s going to wane significantly. It might wane partially, but the expectation is that it will be replaced post-COVID.” Shares were trading 3.77% higher nearing the close.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.