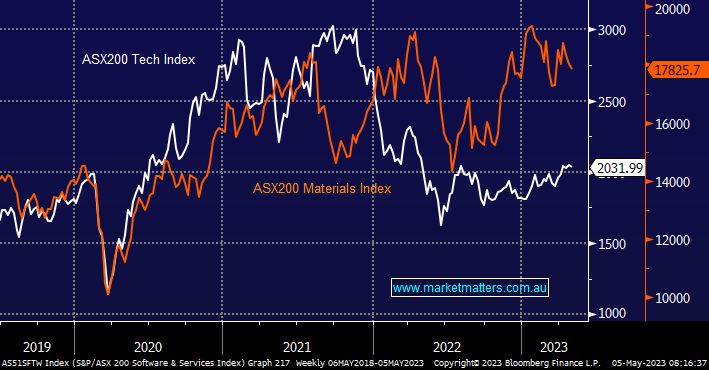

MM has often rotated between the tech and miners since COVID largely using bonds as a guide i.e. falling bond yields are supportive of growth/tech stocks. The markets currently becoming increasingly concerned that a recession is looming which is not being helped by the ongoing banking woes in the US e.g. crude oil trading back towards its 2022 lows even as OPEC+ cuts production reflects this perfectly. We believe these worries have further to unfold hence even as we’ve started trimming our tech exposure into strength we haven’t waded aggressively back into the miners, there on the menu but not yet.

- We are looking for further convergence between the 2 sectors with the Materials Index being more likely to come down to the Tech index.