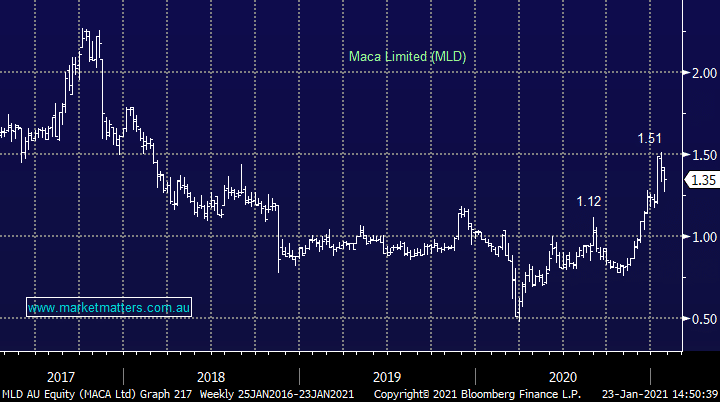

MLD is a WA based mining services business valued at $461m which currently yields 3.65% ff, the company recently purchased Downers mining services business demonstrating its expansion plans. When the company reported in early 2020, before coronavirus took hold, they delivered 48% increase in net profit for the half year to $12m and the stocks forecast to yield 3.6% fully franked over the next 12-months painting a solid fundamental picture.

MM is already enjoying strong returns from our mining services positions in NRW Holdings (NWH) and Monadelphous (MND) implying the sectors a solid one, the question being should investors consider going further up the risk curve with MLD? The stocks probably a touch small / illiquid for ourselves but we like it all the same.