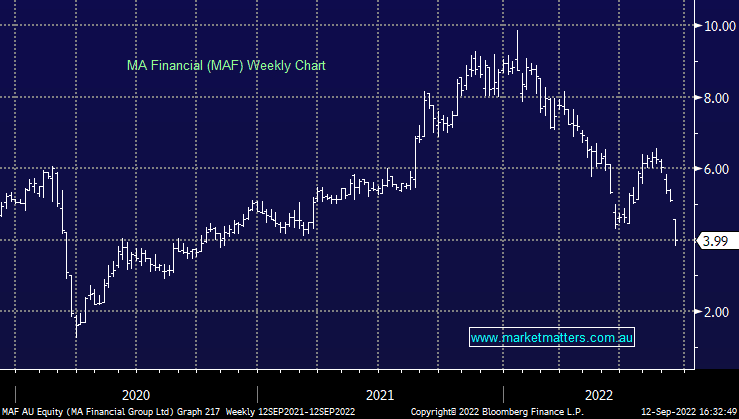

MAF -21.76%: the asset management company traded down to nearly 2-year lows today on news the Australian Government was looking at changes to the Special Investment Visa (SIV) process. Under the current system, migrants can effectively skip the queue before investing $5m in approved investment schemes, of which MA Financial run a number of products for. Currently, around 50% of the total $7.2b under management comes from high net worth investors, however, MA Financial said the figure coming from SIVs is closer to 37%. The company reiterated FY22 guidance (December yearend) of 30-40% growth in underlying EPS, while 85% of gross fund inflows for the first 8 months of the year were not “from clients under the migration related programmes.”

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral MAF here

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.