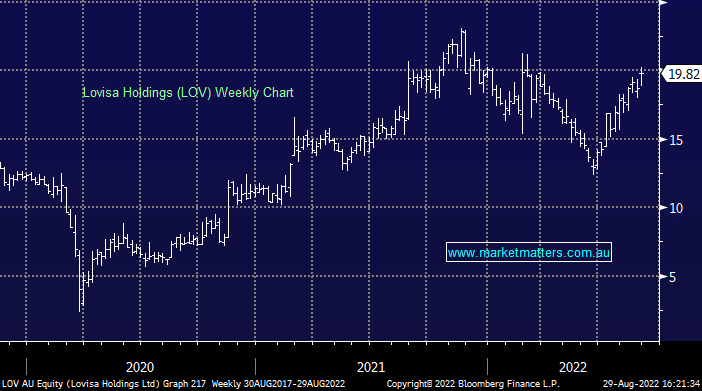

LOV +6.16%: one of only a handful of medium/large cap stocks to trade higher today against the broader market weakness, rallying on a strong FY22 result with positive outlook commentary. The jewellery retailer was 8% ahead of consensus at the revenue line, printing $459m, up 59% on FY22. EBIT was slightly ahead at $142.5m, and profit more than doubled on a comparable basis at $58m, a 10% beat to consensus. One of the key reasons we like Lovisa is its high gross margins which climbed to 78.9%, however, this was partly offset by higher marketing spend. Sales momentum has continued to into FY23, up 21% on last year for the first 7 weeks. It has also opened another 22 new stores in the new financial year to further boost performance.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains bullish and long LOV

Add To Hit List

Related Q&A

Lovisa (LOV)

Thoughts on IEL, LOV, FDV and TYR please

Does MM like currently PMV, LOV &/or SUL?

MM’s thoughts on LOV, PMV and SUL please

Would MM buy Lovisa (LOV) at current levels?

How does ASX200 Quarterly rebalance impact stocks?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.