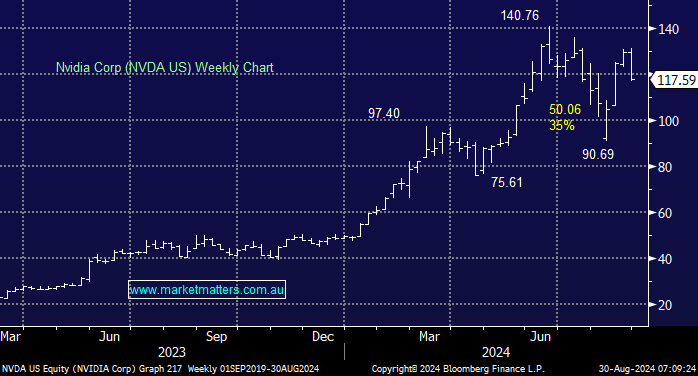

Artificial Intelligence (AI) has often been the market’s focus over recent years, and never more so than yesterday after Nvidia (NVDA US) posted its second-quarter results. In summary, the world’s most famous AI play produced US$30 billion revenue in the quarter, its adjusted earnings per share (EPS) rose by 152%, and it is planning a US$50 billion share buyback, but the stock still fell over 6%, with “great” not being good enough after the stock’s parabolic gains over the last year.

- Revenue +15% q/q, +122% y/y to US$30 billion

- Operating expenses +48% y/y to US$2.66 billion.

- Diluted EPS of US$0.25/share.

- Approved an additional US$50 billion in share buybacks

NVDA’s 2nd quarter result was undoubtedly strong, with the company beating expectations both in the quarter and in terms forward guidance, just not be as much as some thought they would. The result further confirmed that the shift towards AI is a real, impactful technological change that will play out over multiple years. However, how best to profit from this evolution is a whole new story:

- Fun Fact: Overnight Citi named Apple (AAPL US) as its number 1 AI pick.

- We believe this particular mantle is likely to change hands a few times over the coming years.

The race for AI supremacy is a fast and expensive journey, and unless a company has a small niche, it is likely to be a case of “get big or get out”, with the magnitude of NVDA’s buyback illustrating that perfectly.