Lithium stocks tumbled today, making up 8 of the worst 10 performers in the ASX200 for the session. The move came after rumours a Chinese battery manufacturer was set to significantly cut output expectations resulting in softening demand for the battery mineral by as early as the middle of next year. The news caused one Chinese lithium futures price to drop by more than 7% in the session, though the rumours are yet to be confirmed, or the company expected to downgrade been named. Pilbara (PLS) was caught up in the selling, and adding to the pain was AusSuper whose holding fell below the significant shareholder threshold after being net sellers for much of the last week.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM are cautious on the crowded ESG trade short-term

Add To Hit List

Related Q&A

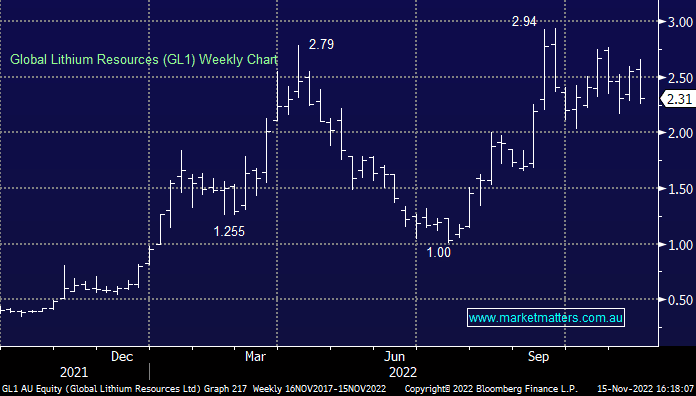

GL1 Global Lithium (GL1)

What are MM’s current top 3 picks today from the Emerging Companies portfolio?

Cutting losses in the Emerging Portfolio

Thoughts on BCB and GL1 please

Current view on Global Lithium Resources (GL1) please

Core Lithium

GL1 still good?

MM’s thoughts on GL1 and USHY please

Is Global Lithium Resources (GL1) a good buy at current levels?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.