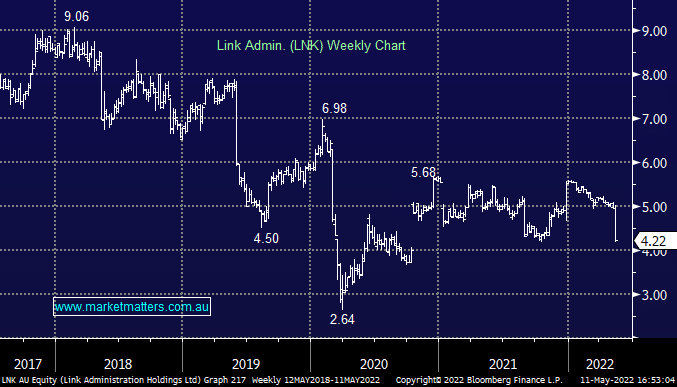

LNK -15.09%: the company administration group was smacked today only a day after suitor Dye & Durham lodged takeover documents. Dye & Durham was expected to takeover Link at $5.50/sh in a deal announced late last year however concerns are now being raised around the funding needed to secure the takeover. An independent expert cleared the deal and Link’s board moved to vote in favour of the takeover ahead of a shareholder vote in July. Dye & Durham had organised a $3.5b loan from a number of creditors, however, the market has fears that the loan, which is more than 3x the market cap of the Canadian listed suitor, is excessive. The ACCC has also delayed its ruling on the takeover with provisional findings now expected in late May. LNK shares are trading at a ~25% discount to terms.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains neutral LNK

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.