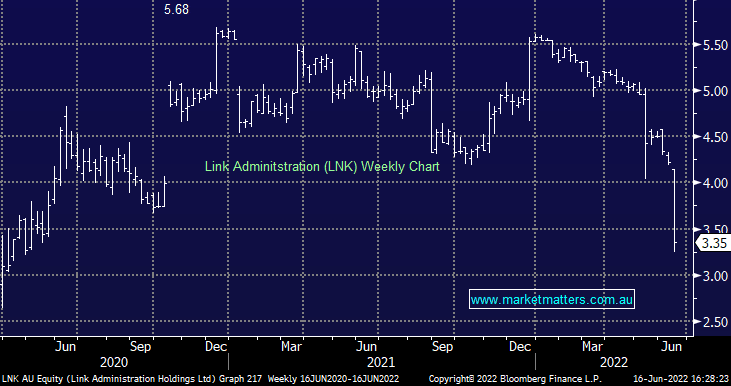

LNK -10.43%: the corporate administration business copped a double whammy of bad news today which sent the stock to a 2-year low. The ACCC released preliminary concerns around the takeover by Canadian group Dye & Durham which aired concerns around competition given Link’s stake in digital property settlements and conveyancing business PEXA (PXA). Dye & Durham offers a software solution used by lawyers and conveyancing firms used for property settlements which the ACCC fears could vertically integrate with PEXA’s business to squeeze out any competition. The $5.50/sh cash off for Link is now 64% above today’s close, but is unlikely to proceed in its current state. Link was also taken to court in England with papers lodged regarding a class action from their involvement in the Woodbridge Income Fund collapse. While the issues seem to be stacking up for Link, there is value in the underlying business.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is adding LNK to the watchlist – it’s cheap but with a few warts!

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.