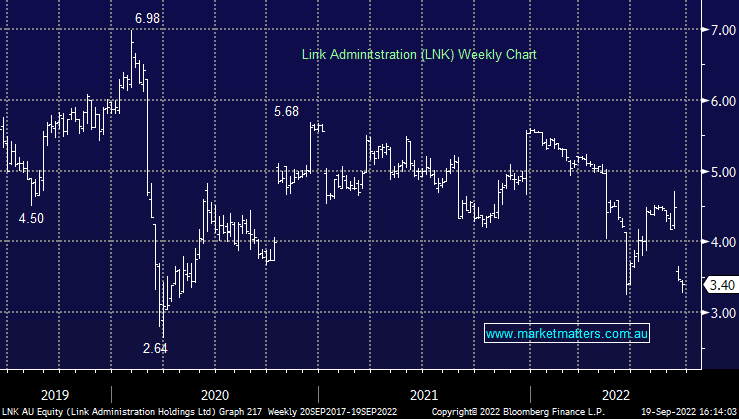

LNK –2.02%: an updated bid from Dye & Durham has come through following the UK court’s decision to only allow a takeover of Link if a redress facility is arranged to cover potential claims regarding the collapse Woodford fund. A ~$500m facility would be housed separately in case any losses from the collapse was to fall on Link’s shoulders. As a result, Dye & Durham has reduced their bid by $1/sh to $3.81/sh cash, while shareholders would also be entitled to their share of any unused portion of the facility. Link has rejected the terms with the view that there should be any claims against them. Link would likely fight harder to prove that, while Dye & Durham would see no upside in attempting to reduce the claim below the potential $500m. Unless the two parties can work this through, a deal looks unlikely until a final decision is made on Woodford, which could be over 12 months away.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has no interest in LNK here

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.