360 +11.74%: the digital safety company provided a strong 1Q update today as the company sits on the cusp of breakeven for the first time. Gross profit was up 40% with margins expanding 400bps as software subscription revenue grows as a proportion of sales. With operating leverage working its magic, the company posted an EBITDA loss for the quarter of just -$0.5m which compares to a FY EBITDA loss of $40m in FY22. From here, management expects to be operating cash flow positive in each quarter, grow subscription revenue by more than 50% and gave FY revenue guidance of $300-310m, in line with consensus. Shares hit a 5-month high today thanks to the strong update.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

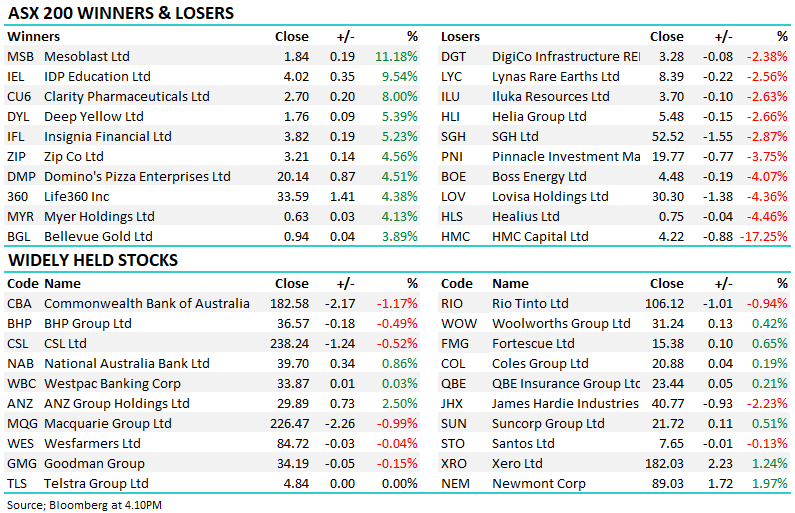

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

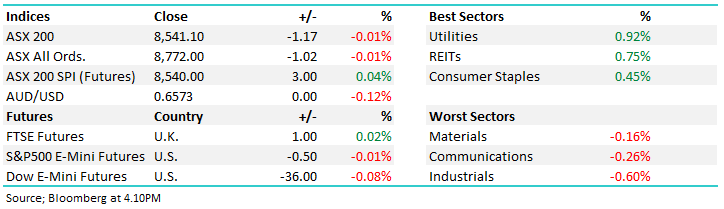

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Close

Close

MM is bullish 360 ~$6

Add To Hit List

Related Q&A

US stocks listed in the US

PMV and 360

Thoughts on Life360 (360) please

Hold, or cut Life 360?

Thoughts on Life360 (360) and ZIP Co Ltd (ZIP) please

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.