360 +38.48%: the share price of tracking and digital safety business Life360 surged into double digits for the first time since 2021 on a strong FY24 report out this morning. Earnings came home with a wet sail, EBITDA of $US20.8m was ~45% ahead of consensus and smashed the $US12-16m guidance out of the park. Hardware was the main driver, the company getting a sugar hit from better penetration in Australia, UK & Canada while revenue growth in the more mature US market was still 14%. Operating costs fell from 88% of revenue to 68% from CY22 to CY23, driving better margins. Guidance was also a ~10% beat to consensus, driven by further subscription growth and price increases.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

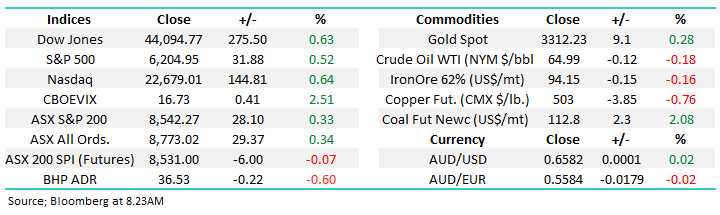

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Close

Close

Monday 30th June – Dow up +432pts, SPI up +5pts

Monday 30th June – Dow up +432pts, SPI up +5pts

Close

Close

MM remains bullish 360, looking for a pullback

Add To Hit List

Related Q&A

US stocks listed in the US

PMV and 360

Thoughts on Life360 (360) please

Hold, or cut Life 360?

Thoughts on Life360 (360) and ZIP Co Ltd (ZIP) please

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 30th June – Dow up +432pts, SPI up +5pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.