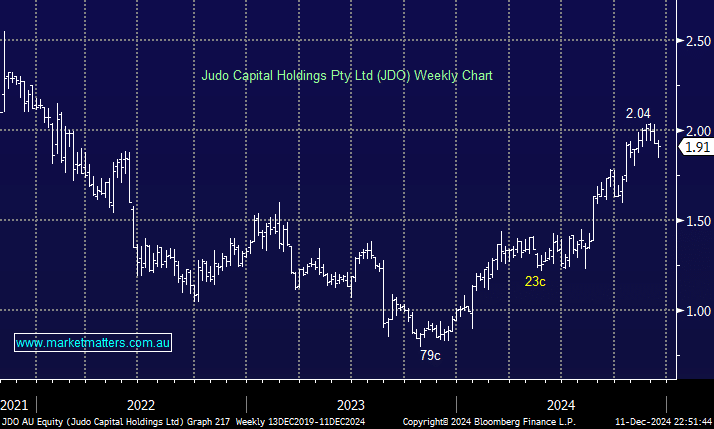

Goldman sold 6.4% of the shares on the issue at $1.85, above the guided floor price of $1.83, representing a 3.1% discount to the last close. The selldown leaves Bain and GIC holding just under 10% of the company, which trades as Judo Bank. For subscribers unacquainted with JDO, it’s a local financial institution that provides banking and lending services tailored for small and medium-sized enterprises (SMEs). In contrast to the “Big Four”, JDO emphasises personalised banking through dedicated relationship managers and offers flexible lending solutions rather than a one-size-fits-all approach.

This rarely discussed $2.1bn bank booked net profit in FY24 of $70m, however this is expected to lift materially in the next two years to be above $200m. As we often say at MM, share prices follow earnings over time, and JDO is growing profits nicely.

- We like JDO with weakness below $1.80 providing solid risk/reward.