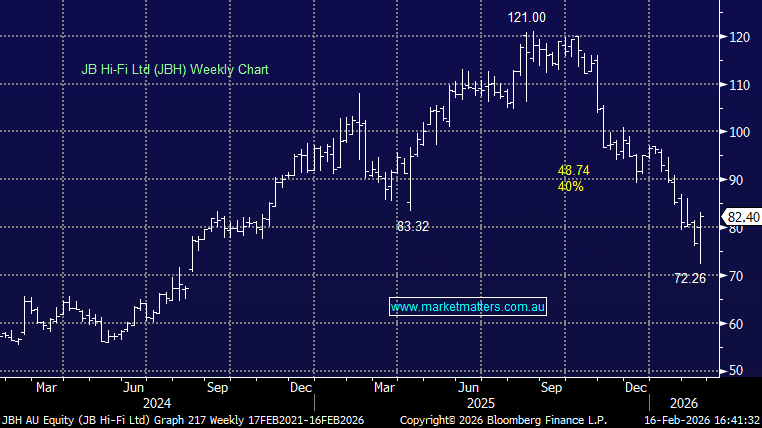

JBH +7.46%: A solid 1H result, with earnings in line with expectations and the business continuing to execute well in a competitive retail environment. While January trading was softer (+2.4%) and management struck a cautious tone, the market had already priced in plenty of bad news after the stock’s recent pullback.

- Sales $6.09bn, +7.3% YoY (vs $6.03bn est.)

- Net income $305.8mn, +7.1% YoY (vs $305mn est.)

- Interim dividend $2.10 (vs $1.70 YoY)

The board lifted the dividend payout ratio to 70–80% of NPAT, highlighting confidence in cash generation and balance sheet strength. Growth categories such as mobiles, computers and appliances continued to drive momentum, and while cycling strong prior-year comps makes the near-term outlook more uncertain, JBH remains well positioned.

A good result from a high-quality retailer. JBH has been sold off into the print, so an “inline” outcome with strong cash and higher dividends is enough to keep the stock well bid. We remain positive on JBH after strong execution in a tough environment, though we’re conscious of the choppy retail backdrop.