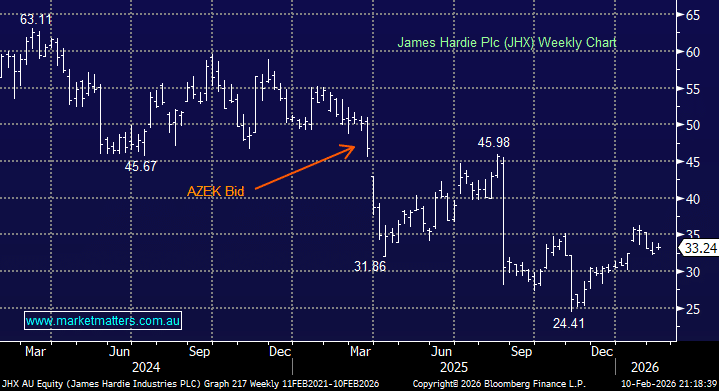

JHX released a 3Q trading update after market in the US, which reads pretty well considering, with integration and cost improvements from its AZEK acquisition ahead of schedule.

3Q26 Highlights

- Net sales of $1.24bn +30% YoY and above $1.21bn consensus.

- Adjusted earnings (Ebitda) $142.2m ahead of $133m consensus

The company lifted its FY26 earnings (Ebitda) forecast slightly to $1.23-1.26bn (vs $1.22bn consensus), while still seeing free cash flow of at least $200mn.

- A reasonable result vs expectations, containing no nasty surprises for a company historically capable of much worse; we believe it should be well received.