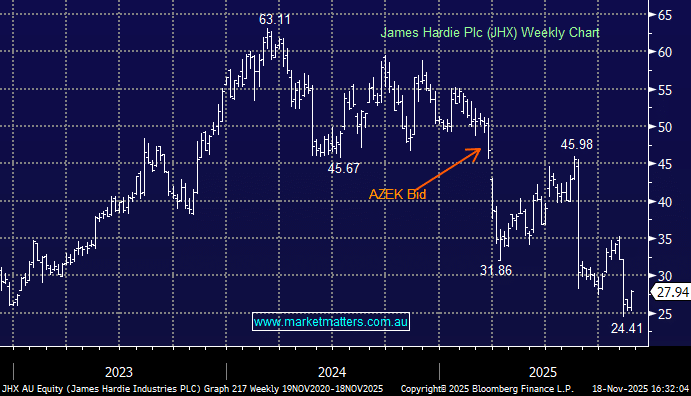

JHX +9.8%: One of the few positive stocks on the ASX today with the index down ~2% – the building and construction business jumped after lifting its FY26 EBITDA guidance to US$1.20–1.25bn (from US$1.05–1.15bn), as they signaled improved execution in their U.S segment. Shares in the US overnight rallied as much as 16% following the news, suggesting growing confidence that Hardie’s cyclical low may be behind it.

The update reflects steadier demand for home siding and trims in the US and normalised channel inventories after what had been a turbulent first half for the broader building materials sector. Importantly, the recently acquired AZEK Co. business is already outperforming expectations, with targeted cost synergies realised ahead of schedule, providing much needed validation of the deal that has drawn scrutiny.

We remain patient holders of the stock in our Active Growth Portfolio, viewing the upgraded guidance as a strong step in rebuilding investor confidence after several quarters of uncertainty. While execution risk around the AZEK integration remains, the company’s delivery on synergy targets and the stabilising US demand backdrop reinforce our constructive medium-term stance.