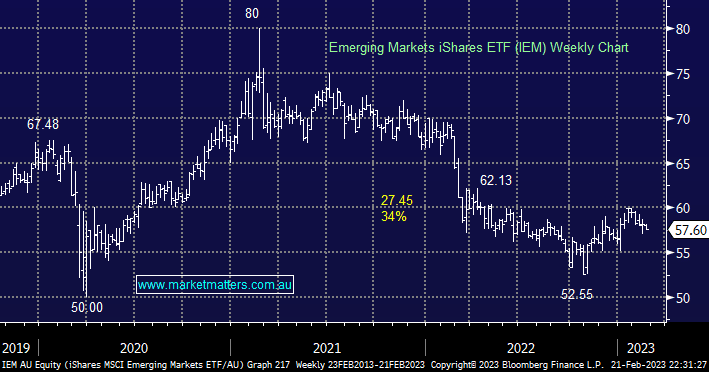

The emerging markets have bounced along with most indices from last October although a resurgence by the $US has weighed on performance over the last few weeks. This is a basket of stocks that run their own race and at this stage, we like the exposure as China’s reopening should help the Asian region in particular – we may consider exiting our IEM ETF position ~8-10% higher depending on how the China v central banks balancing act is playing out.

- We currently like holding an ETF with large China exposure as it reopens from COVID.

NB The main exposure for the IEM ETF is 31% in China, 14.6% Taiwan, 13% in India and 11.9% towards South Korea with the next largest holding being 5% in Brazil.