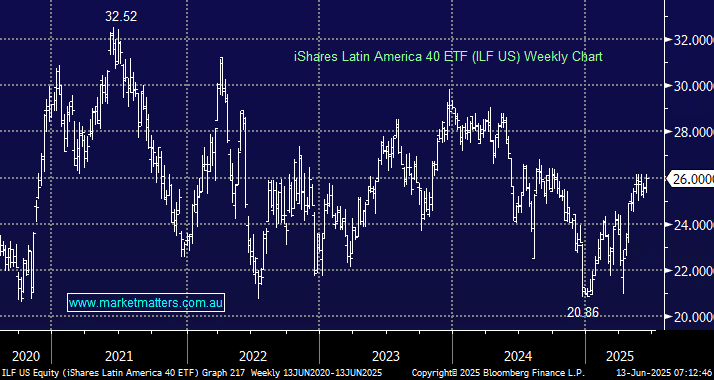

The ILF aims to track the S&P Latin America 40 Index which comprises of 40 of the largest companies in South America including Brazil, Mexico, Chile, Peru and Columbia. The ETF cost 0.48% pa and does a good job of tracking the Index over time, underperforming the index by only 0.18% over the last 5-years. This is an interesting ETF that provides exposure to a region rarely discussed, and it’s not as heavily mining-focused as many may think, with more than 50% of its investments spread across banks, beverages, retail, and telecommunications. We like this ETF, but only when MM feels it’s time for the region to regain some love.

- The ILF ETF looks and feels too hard at the moment, as it underperforms global markets.