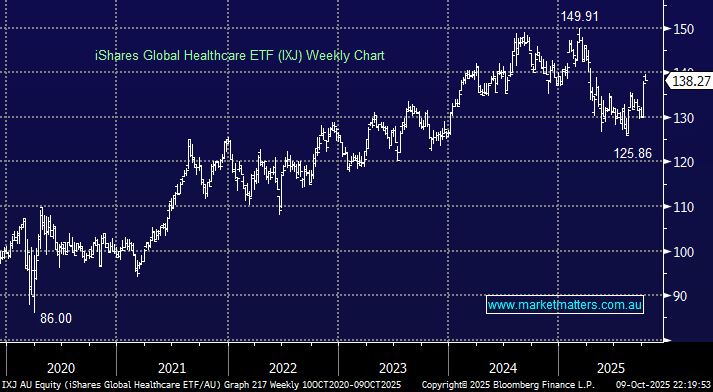

This major global healthcare ETF has a market cap in excess of $1.3bn, allowing investors to gain exposure to the sector while ironing out the huge influence of CSL locally. This ETF currently has 68.6% in US companies, followed by 9% in Switzerland and 5.5% in the UK, with local names playing more of a “bit role” with the ETF looking to track the S&P Global Healthcare Index. The ETF costs a reasonable 0.41% to provide exposure to a basket of global healthcare names from pharmaceuticals to healthcare products and services.

- We like the IXJ ETF for simple ASX-traded exposure to global healthcare when the time is right for investors not wanting to take on the local stock-specific volatility.