The IXG ETF seeks to track the return of the S&P Global Financial Index, which currently has around 46% invested in banking stocks, followed by 24% in insurance and 20% in diversified financials. Across the globe, the IXG’s current exposure is led by 54% in the US, 6% in Canada, 6% in the UK, and 5% in Japan. We note that this is not a currency-hedged ETF; hence, investors will experience some movement courtesy of FX markets. Of the 216 stocks held, the five largest positions are Berkshire Hathaway 6.6%, JP Morgan 6.1%, Visa 4.6%, Mastercard 3.4%, and Bank of America 2.3% – an excellent mix of global financials.

- The IXG ETF has a relatively small 0.41% expense ratio considering its international mix, and it tracks its benchmark very well; Over the last 3 years, the IXG has advanced by 23.1% while the S&P Global Financial Index has gained 22.8%.

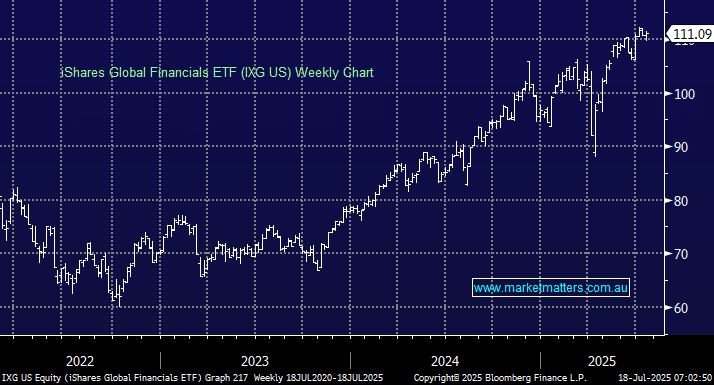

The IXG ETF looks well-positioned to extend its recent gains in line with the bull market, although its forecasted 2.2%, non-franked yield, isn’t as attractive as the local names.

- We are bullish on the IXG ETF, initially targeting new highs in line with our bullish but choppy outlook into Christmas.