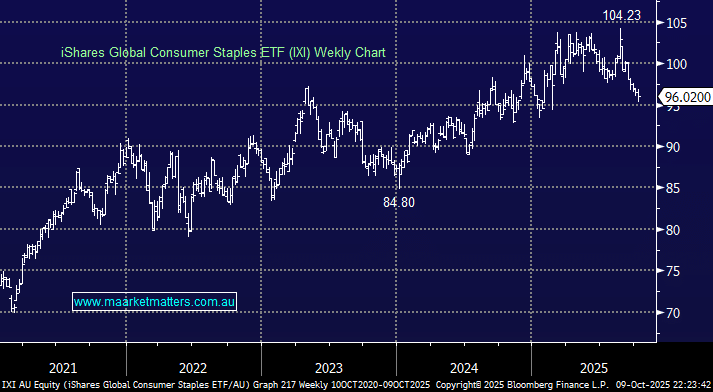

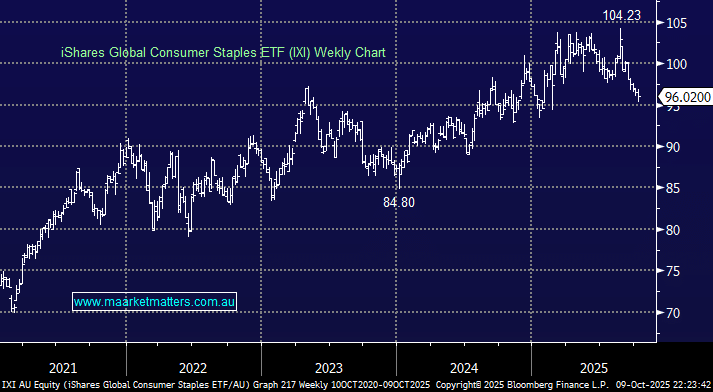

This major global consumer staples ETF allows investors to gain exposure to the Global Consumer Staples Index. It currently holds 60.5% of its assets in the US, followed by 11.8% in the UK and 5.9% in Switzerland; Australia comes in with just 1.1%. The ETF costs 0.41% pa to deliver this exposure, which is reasonable for global exposure.

- We like the IXI ETF for simple ASX-traded exposure to global consumer staples stocks, but it feels too early to fade the current weakness.

Again, Woolworths (WOW) as a contrarian play and Metcash (MTS) offer better alternatives in our view, paying more attractive fully franked yields.