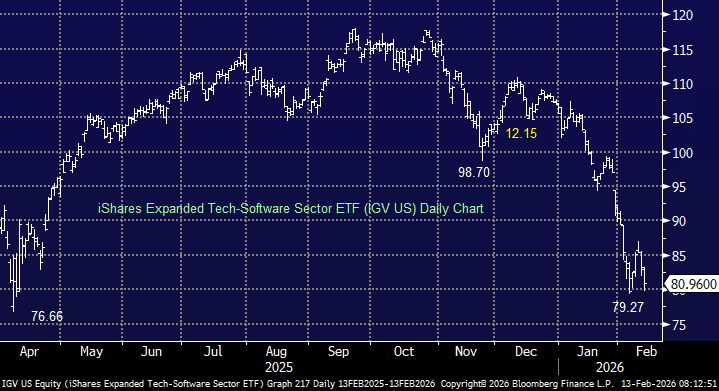

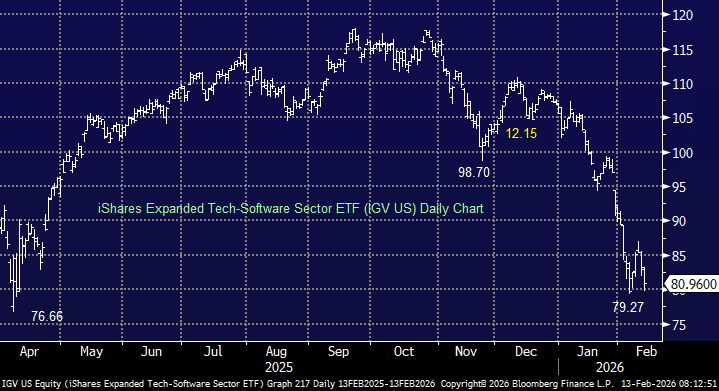

This $US7.5bn ETF not surprisingly suffered net outflows of $US2.58bn in the past year exacerbating the weakness across the US sector – it holds the likes of Microsoft, Palantir, Oracle, Salesforce, Intuit and Adobe. As we alluded to earlier the IGV ETF turned down around 3-months after the local ATEC ETF, and has also outperformed by ~8%. From a technical perspective its stronger and clearer than the local ETF, which hasn’t enjoyed any meaningful bounce since it turned lower, whereas the IGV was capable of a +12% partial recovery in late 2025.

- We see room for the IGV ETF to fall toward the US$75-6 level, around 6% lower from here, where risk-reward would begin to look more compelling, provided downside momentum shows signs of stabilising.