AI may be grabbing the spotlight and powering U.S. market returns, but a different story has been unfolding in Europe. Once you remove Nvidia (NVDA) from the S&P 500, the index’s performance since late 2022 actually falls behind that of the eurozone’s MSCI EMU Index. It’s a striking comparison, highlighting how much U.S. gains have hinged on a small group of mega-cap names rather than broad market strength. Meanwhile, Europe has been quietly building momentum. After years of trailing U.S. equities, eurozone markets have strengthened on the back of cooling inflation, better economic outlooks, and support from the region’s more cyclical, value-tilted industries. Sectors like industrials, financials, and luxury goods have benefited from both internal recovery and robust global demand.

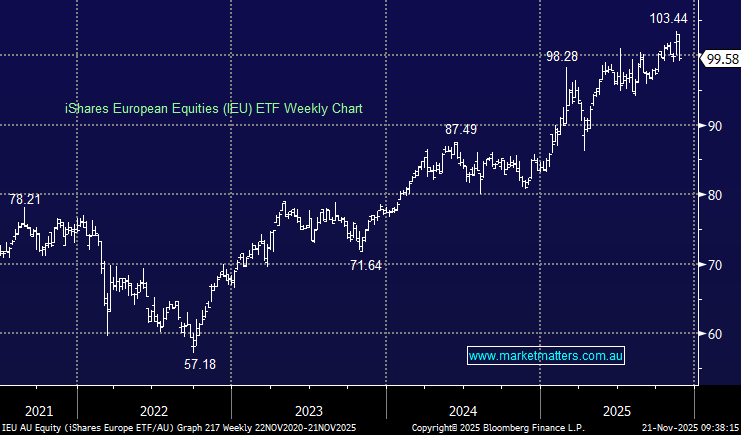

With valuations in segments of U.S. tech looking stretched, Europe stands out for offering a healthier balance between growth opportunities and downside protection. Adding European equities to a portfolio can provide access to a different style of expansion – more stable, value-anchored, and gradually bolstered by technology. For investors uneasy about the exuberance surrounding U.S. AI leaders, Europe offers a way to rebalance toward markets where fundamentals and pricing are more closely aligned. A straightforward entry point for broad regional exposure is the iShares Core MSCI Europe ETF (IEU).

- The ETF holds 1,011 stocks, with its 5 largest holdings all less than 2%: AstraZeneca, Roche, Nestle, SAP and Novartis.

- From a regional perspective, it has 22% exposure to the UK, 15% France, 15% Switzerland, 14% Germany, and 7% the Netherlands.

- It has a substantial market cap of $US6.5bn, while its fees are very low at 0.09%.

We expect ongoing volatility as we head into Christmas, with value stocks likely to outperform. Europe has a greater number of these stocks’ relative to the US, which makes this ASX listed ETF an attractive proposition for international exposure with less tech.

- We like the IEU as the “AI Trade” valuation gets called into question, believing it will outperform US markets into 2026.