This ETF aims to provide investors with the performance of the Bloomberg AusBond Composite Bond Index. The index is designed to measure the performance of the Australian bond market and includes investment-grade fixed-income securities issued by the Australian Treasury, Australian semi-government entities, supranational and sovereign entities and corporate entities.

- Advantage: Low cost (0.1%) diversified exposure to Australian investment-grade fixed-income securities whose dividends are paid quarterly – the last 12 months yield was 2.83%. It primarily invests in fixed-rate bonds. Hence, it is not directly linked to the RBA Cash rate.

- Disadvantage: This is a low-risk ETF with a lower yield than some in the group.

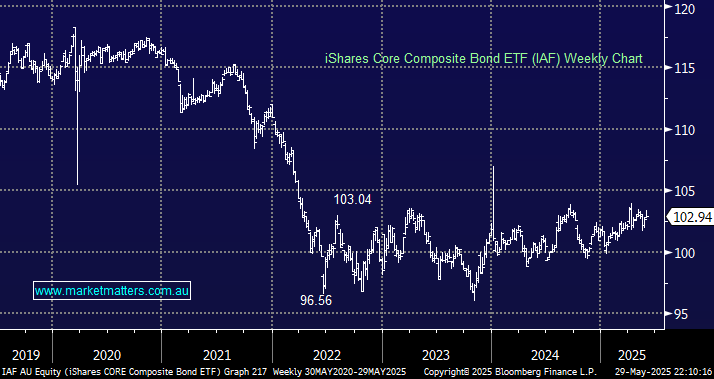

We like the IAF for low-risk bond exposure, which won’t be at the mercy of the RBA: MM owns the IAF ETF in its Core ETF Portfolio.