The iShares Asia 50 ETF (AIA) is one of the largest Asia-focused ETFs, providing exposure to 50 of the largest Asian companies across various sectors, including technology, financials, and telecommunications. The ETF costs 0.5% pa for exposure to a diverse basket of 57 Asian stocks from countries such as China, Taiwan and South Korea, with a heavy bias towards tech; it currently holds ~60% in semiconductor and internet stocks. The ETF aims to track the S&P Asia 50 Index and, over recent years, has tracked the index within 0.5%, which is solid considering it’s an unhedged ETF with a portfolio of stocks from various countries.

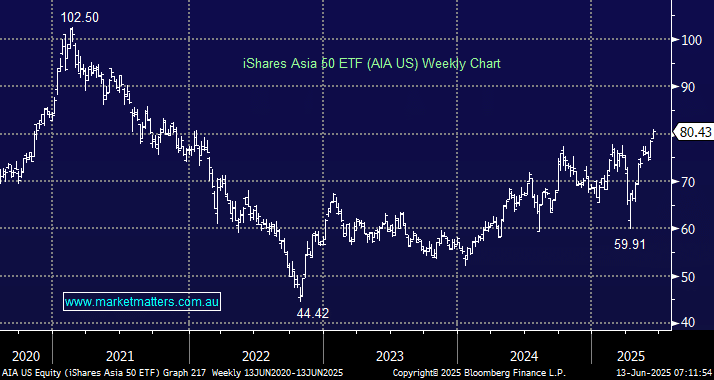

- We like this US-traded ETF for relatively low-cost exposure to a diverse basket of Asian stocks, although the risk/reward above $US80 is average.

NB: Exposure to Asian markets via an ETF is also available on the ASX under the code of ASIA, though it has a far higher skew to technology stocks – it is the Betashares Asia Technology Tigers, we wrote about it here.