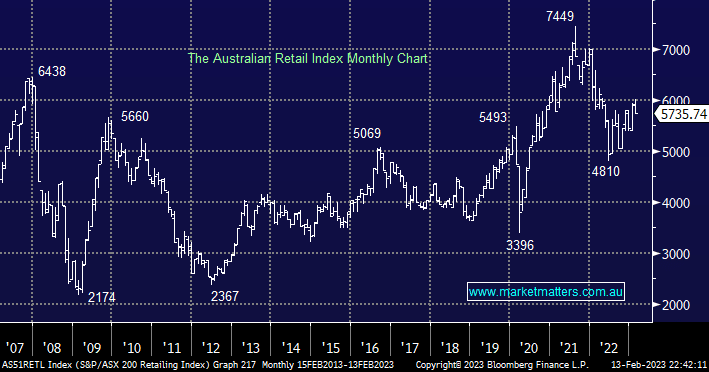

The Australian Retailing Sector fell across the board yesterday with all 8 members closing down after JBH’s sobering outlook i.e. they’ve witnessed sales growth starting to moderate from the elevated levels enjoyed through 1H. The concern for Australian investors is simple if arguably the country’s best retailer is starting to feel the pinch how will the others cope?

- There are signs that Australia’s cashed-up consumer is reigning in spending as interest rates start to bite – clearly bad news for retail.

We have very little direct exposure to the Australian consumer across our portfolios at present and with rates set to be “higher for longer” through 2023/4, the stance is justified in our opinion. However, when sentiment becomes extremely bearish towards one particular sector opportunities do arise hence it’s important for us to be prepared moving forward even if we aren’t buyers today.