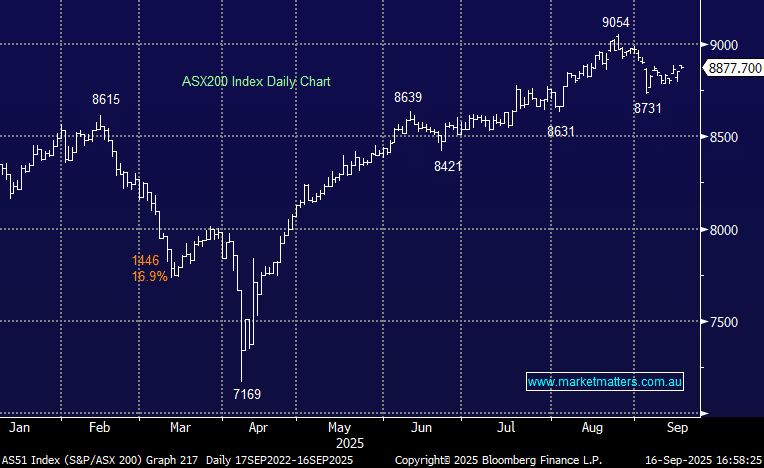

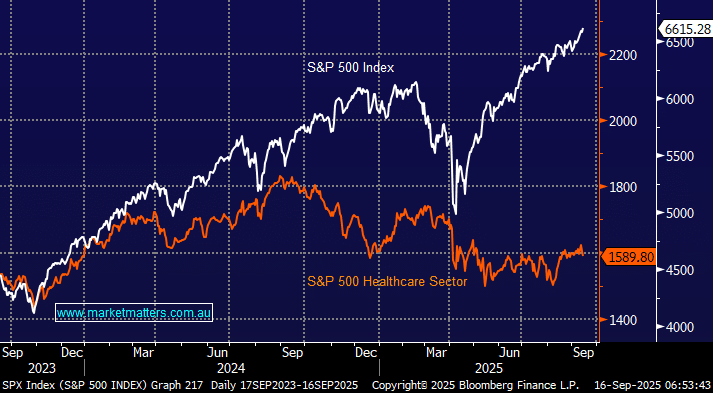

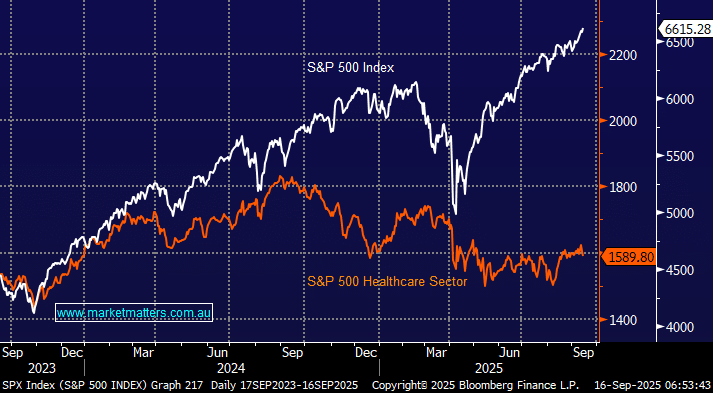

As we touched on in Macro Monday, in cycles where four or more cuts were needed, the healthcare and staples delivered the highest median returns – they’ve returned ~20% during cycles when the Fed needed to cut rates deeply. So far, the healthcare stocks have underperformed on the global stage over the last 12-months, not just in Australia. The chart below shows they’ve significantly underperformed in the US, while in Australia, year-to-date, the ASX200 has advanced +8.5% while the healthcare sector is by far the weakest, falling -14.8%. A painful 27.4% retreat by heavyweight CSL hasn’t helped matters locally, but over 50% of the main sector has also fallen so far this year.

- Futures markets are pricing in 5 Fed cuts over the next 12-months and one more in early 2027.

Hence, the obvious question is, why aren’t the healthcare stocks enjoying a bid as they have in the past? We feel it’s because the market is looking through the economic risks, necessitating the rate cuts, and focusing on the benefits they deliver. Investors are adopting a “risk on” attitude, focusing on the recent solid reporting season, the benefits of aforementioned rate cuts and the expected profitability from the AI revolution.

At this stage, we see no reason to take a contrarian stand towards the healthcare sector, but we can see it starting to address the significant underperformance at some stage this month, with the ducks already aligned for the bulls, the more defensive pockets of the markets are waiting their turn. It should also be noted that our main focus at MM is always on individual companies.

This morning we’ve updated our views for four prominent ASX healthcare names, all of which have struggled in recent weeks to greater or lesser degree, with special focus on if and where we might look to buy/add the respective stocks as MM is underweight the sector in our Active Growth Portfolio.