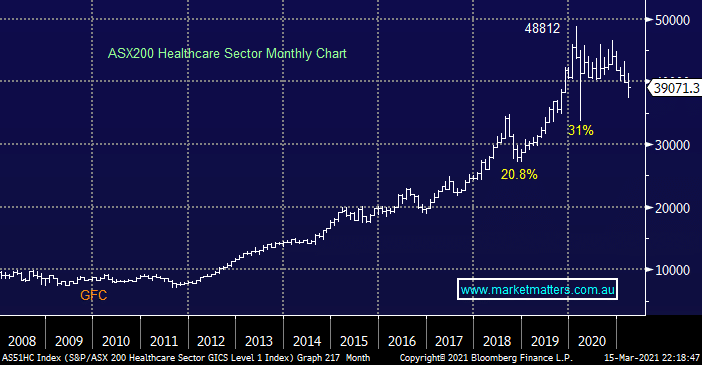

MM has been looking for a recovery by the defensive sectors over recent sessions and its slowly been playing out but the big question is do we believe the likes of Healthcare will rally or simply outperform some hot value stocks that have soared in 2021 – one of the reasons MM took profit from our OZ Minerals (OZL) holding last week. At this stage we like the idea of some selective buying especially as MM currently has a relatively small exposure to the sector through Ramsay Healthcare (RHC) i.e. the Healthcare Sector is almost 10% of the ASX200 but our Flagship Growth Portfolio only has 4% exposure through RHC.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is looking for the Healthcare Sector to outperform this coming quarter.

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.