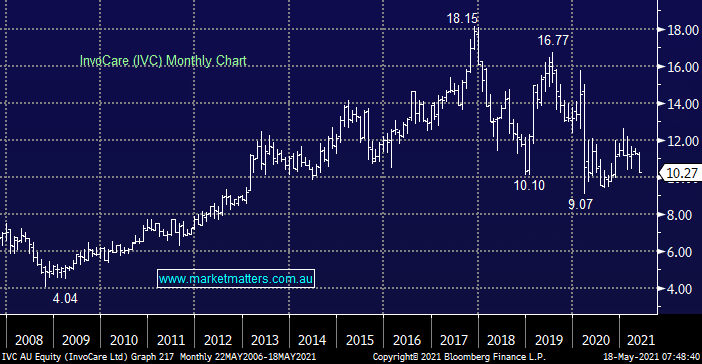

IVC continues to suffer from increased competition and subsequent margin compression. The cheaper competitors boldly display their pricing on line while the likes of White Lady ask you to send an enquiry to talk $$’s, in most areas they are double the cost of the newer operators hence we believe the downward spiral has further to go putting the stock squarely into the too hard basket – a classic case of things rarely staying too good for too long before competition surfaces. This also has a flow effect on their growth through acquisition strategy, increasing the competitive landscape to acquire privately held operators.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has no interest in IVC

Add To Hit List

Related Q&A

External Aus Hold

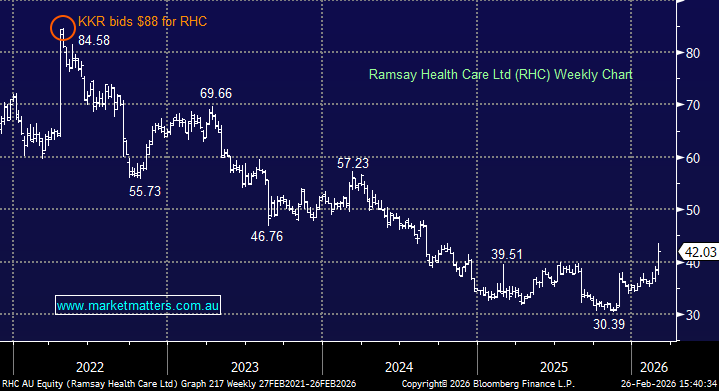

INVOCARE TAKEOVER BY TPG Nov 2023

Thoughts on funeral operator IVC, WPL & A2M

InvoCare (IVC) – any interest?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.