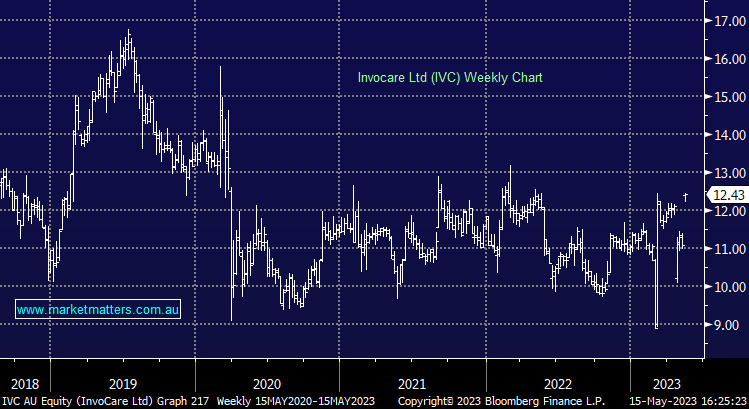

IVC +12.08%: Rallied today after Private Equity firm TPG Capital came back to the table with a $13 bid for the funeral provider, which now has the boards support. It seems like both parties had a bit to lose here and some middle ground was found. No doubt IVC would have been shopping around for a higher price (first bid was $12.65) but clearly, given the +2.8% premium versus the initial tilt that ‘undervalued’ them , they had no luck. TPG already owned 19.9% of IVC, so they wanted something to happen. As they say, if you can find a horse called self-interest, back it! We thought a deal was likely – as discussed here – and that has now played out.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is now neutral IVC

Add To Hit List

Related Q&A

External Aus Hold

INVOCARE TAKEOVER BY TPG Nov 2023

Thoughts on funeral operator IVC, WPL & A2M

InvoCare (IVC) – any interest?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.