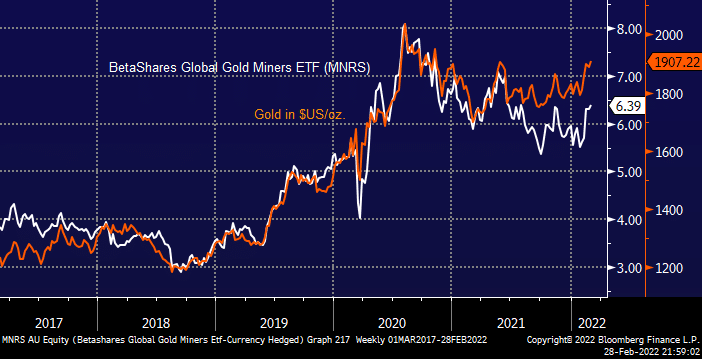

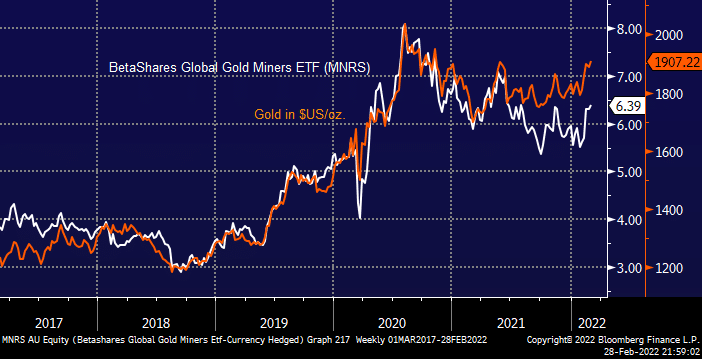

The gold sector both in Australia and overseas has failed to embrace the rally in precious metals over the last 6-months but it caught our attention yesterday because ASX gold stocks edged higher throughout the day even as the precious metal backed off $US30 from its dizzy opening. Conversely we saw oil stocks largely tread water as the energy prices drifted lower during our trading session.

- MM feels investors remain underweight the gold sector as their largely positioned for rising interest rates.

I know we looked at the Gold Sector fairly recently but in todays geopolitical environment things are evolving extremely fast and considering MM is overweight the sector its clearly important to keep our finger on this particular pulse. We believe the gold miners will play some performance catch up to the underlying gold price over the coming months, especially if / when bond yields surrender some of the significant gains over recent months but short-term a pullback feels likely after investors have flocked to precious metals as a safe haven following Russia’s invasion of the Ukraine.