The KBWB ETF aims to track the Nasdaq Bank Index, with this US-traded ETF unhedged for Australian investors, i.e., you are holding $ US-denominated assets. Of the 29 stocks held, the five largest positions are Goldmans 8.5%, Morgan Stanley 7.9%, JP Morgan 7.8%, Wells Fargo 7.7%, and Bank of America 7.5% – an excellent mix of the top US banks, headlined by Goldman’s which we own in the International Equities Portfolio.

- The KBWB incurs a 0.35% expense ratio and tracks its benchmark relatively well; over the last three years, the KBWB has advanced by 14.2%, while the Nasdaq Bank Index has gained 14.6%.

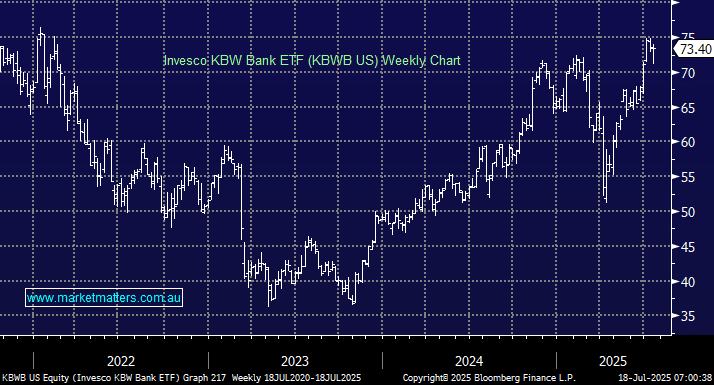

The KBWB ETF looks capable of following the MM roadmap into Christmas, with a break of its 2022 looking likely in the short term.

- We are bullish on the KBWB ETF and initially target a test/break of the $US75 area, only a few % higher.