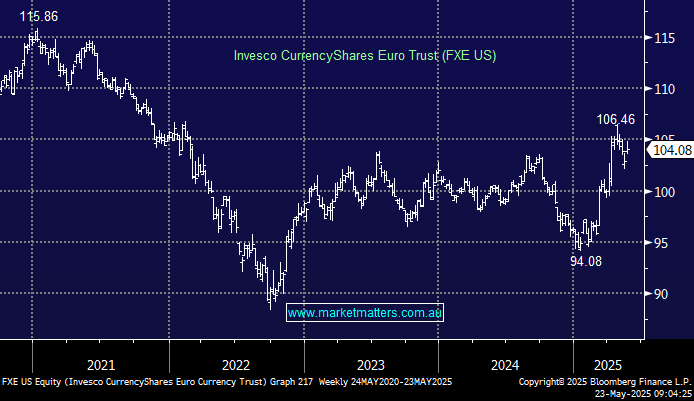

This US-traded ETF is unhedged, but with an expense ratio of just 0.4%, again it’s suitable for longer-term trading/investing for investors/traders bullish on the EURO. Note again that, as a US-traded ETF, local investors are, by definition, holding the $US dollar while looking for the EURO to trade higher against the $US dollar. Having been bullish on the EURO for the last 12 months, we are conscious that the European currency has already traded within 5% of our target area, when combined with a bearish crowded position towards the $US for 2025 the “easy money” being long the EURO feels like its in the rear view mirror, at least short-term i.e. we wouldn’t be chasing strength.

- We can see the FXY ETF testing the $US115 area in the coming year (s), which is around 10% higher.