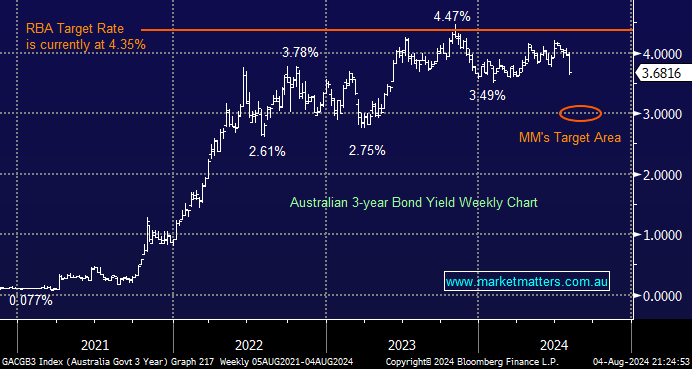

Australian bonds followed their US counterparts higher last week, sending yields significantly lower; i.e., higher bond prices equate to lower yields. After Wednesday’s CPI inflation number and weak US economic data towards the end of last week, the local 3-year yield fell to its lowest level since April as our 3% target came into view. Michele Bullock has a tougher job than Jerome Powell and the Fed, but we continue to believe her next move at the RBA will be an interest rate cut; whether it’s before Christmas is more open for conjecture.

- We are targeting a move down towards the 3% area for the local 3s, a bullish tailwind for rate-sensitive stocks and sectors.

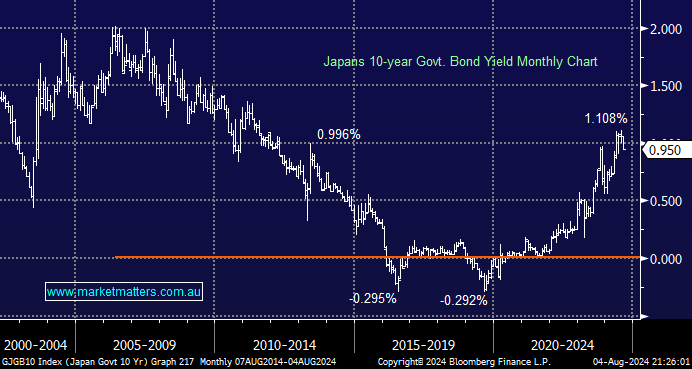

Japanese bond (JGB) yields reversed lower last week after the BOJ hiked its policy rate to around 0.25% from a range of 0 to 0.1%, i.e. classic buy on rumour, sell on fact. The 10-year JGB yield has more than doubled over the last year, and we believe it’s going to struggle to extend the advance into Christmas, suggesting the Yen and Nikkei should consolidate recent moves.

- We can see Japanese Bond yields rotating around the 1% area as the BOJ attempts to normalise rates in an orderly fashion.