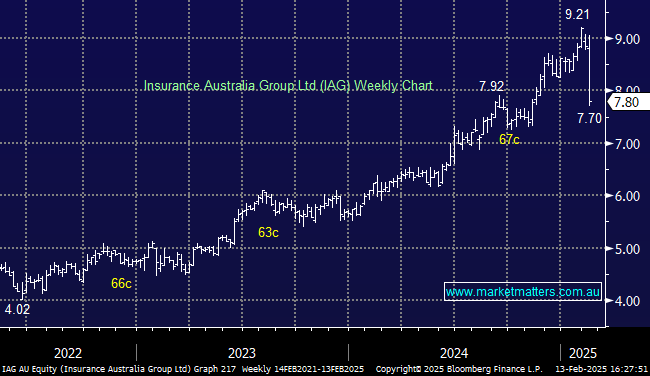

IAG –12.56%: saw its largest single-day drop in the share price in 15 years as it reported first-half earnings that looked okay on the surface but caused concern around the medium-term outlook.

We saw a significant slowdown in premium rates – home and motor at 6% versus 17% and 15% respectively 6 months ago. The result also benefitted from favourable weather… but this may prove to be a rarity given increasingly volatile climate conditions moving forward.

IAG stuck to FY25 net-profit-after-tax guidance of $1.4 to $1.6bn and maintained margin guidance of 13.5% to 15.5%, however given the run up in share price to the result, the market was likely wanting an upgrade. As for capital management, the company declared a dividend of 12cps when the market was looking for 13.7cps; this was coupled with the absence of a further buyback implying a more cautious approach from the board – perhaps for a reason.

- Conditions for the general insurers look to have peaked.