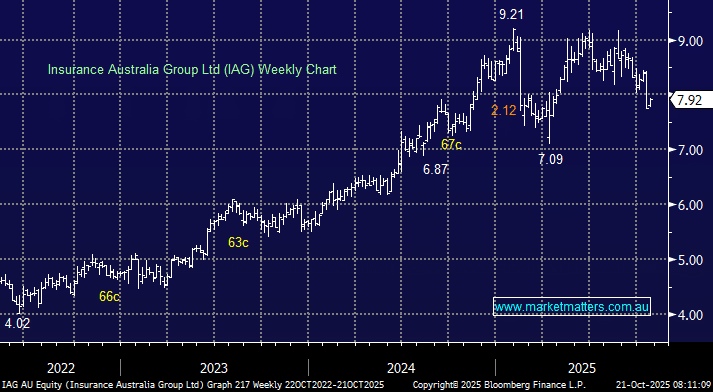

IAG has retreated 16% from its January high, helped by its domestic exposure. However, the stock was smacked back in February after CEO Nick Hawkins provided a more conservative outlook than was hoped for, sending the stock plunging as a classic crowded position, full of momentum traders, unwound in earnest – in hindsight, he was right. At the time, we felt the sector was being priced for perfection, and potentially “peak cycle” – the rest of 2025 has largely resonated with this view, but now it’s starting to feel like the reverse is starting to play out. IAGs reported well for the FY25 with earnings coming in at $1.36bn, up +51.3% from $898mn in FY24, but the insurance sector is looking at the next chapter.

With an ok yield of ~4.3%, it could even become a yield play in time. Even after last week’s sharp decline, this insurer is still too expensive for us, still trading on the rich side of history. IAG is likely to recover more slowly than QBE when the US insurers bottom, but on the flip side, if they keep falling, it should be better insulated.

- We don’t have any interest in IAG nearer $8, but that would likely change on a move into the mid to low $7’s