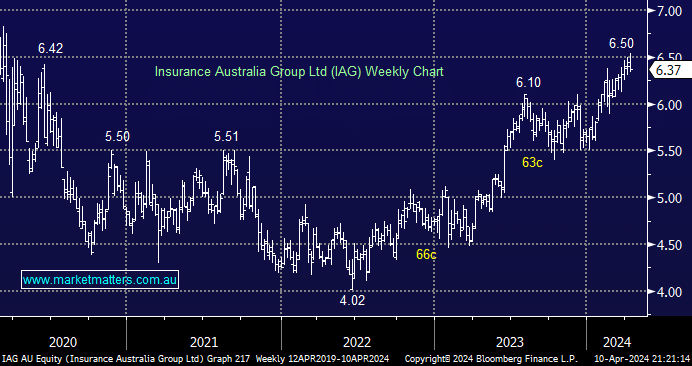

IAG slipped -1.9% on Wednesday, but it’s still up +14.7 % so far this year, well ahead of the broader market. Moving forward, we remain concerned about affordability, volume loss and softening customer retention as premiums increase. IAG’s strong capital position enabled them to recently announce a $200mn buyback, which has helped support the stock, but we still believe it’s getting tired above $6 and would be sellers of strength as opposed to buyers into dips. We see better value elsewhere in the market, especially as we believe recent economic data, which has made investors more realistic towards the path for rate cuts over the next 12-18 months, is being priced into the IAG share price.

- We still have no interest in IAG above $6 at this stage of the cycle.