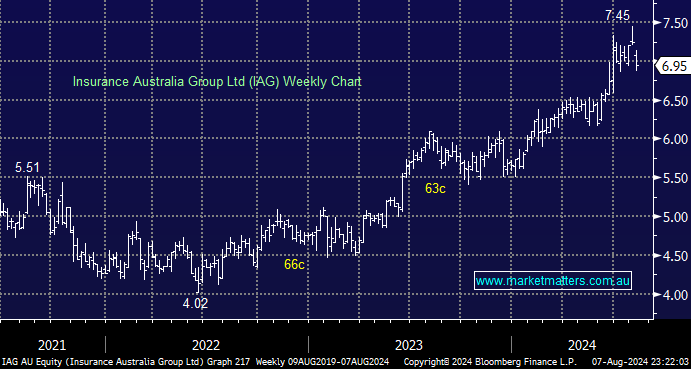

We have been too cautious towards IAG over the last two years, but we currently see little upside for the stock above $7. IAG provided an FY24 trading update in late June with few surprises now expected when it reports on the 21st August – the markets will be scrutinizing its FY25 margin guidance, commentary around pricing, reinsurance and claims. Also, some capital management is anticipated, with a potential $350mn buyback on the cards.

Overall, we anticipate the favourable industry backdrop of ongoing repricing, attractive yields, and slowing claims inflation, should provide a tailwind for IAG margins into FY25.

- We see value in IAG in the $6.50 area, but it’s not on our shopping list.