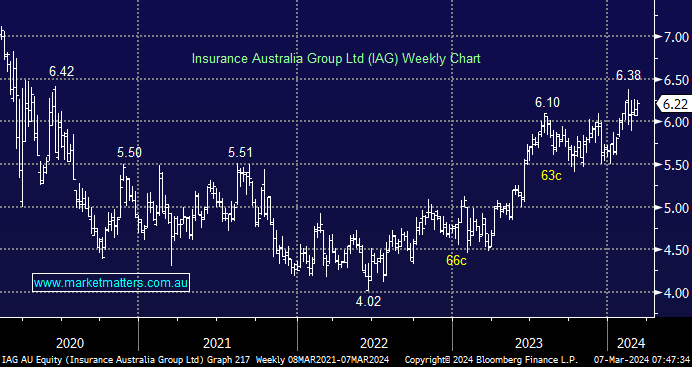

On the surface, IAG’s February 1H24 result was below expectations; the market’s muted reaction suggests that the core result was solid on closer inspection. Stabilising claims is key to their margin outlook, helped by improving motor claims. Looking forward, we see some growing concerns around affordability, volume loss and softening customer retention as prices go up in the 2H. A $200mn buyback has helped support the stock, but we believe it’s getting tired above $6 and would turn sellers rather than buyers into strength.

- We would be fading strength by IAG into fresh 2024 highs, seeing better value elsewhere in the market.