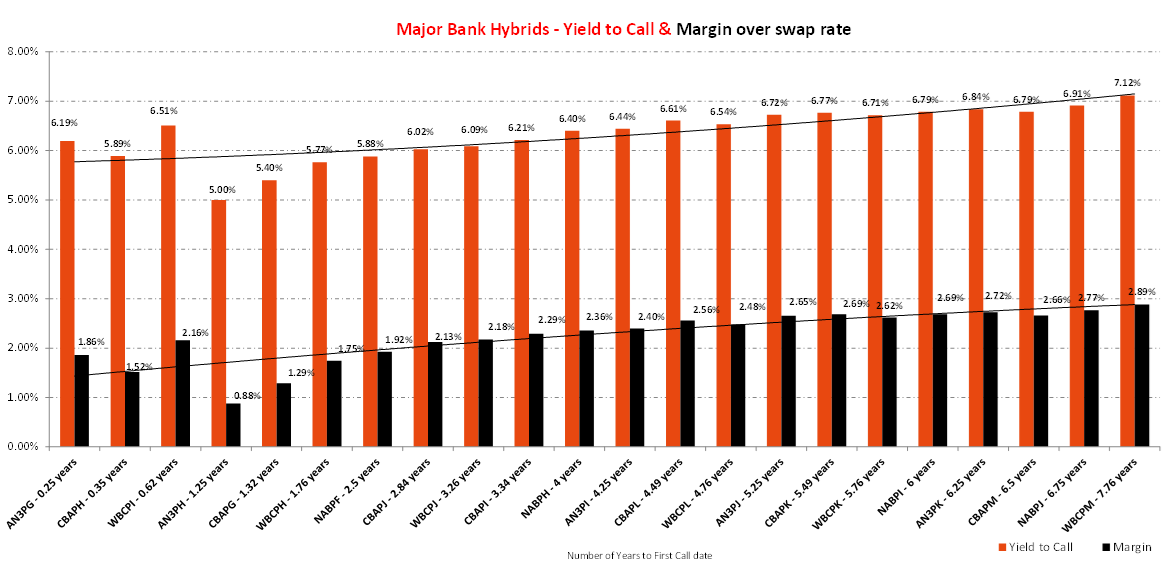

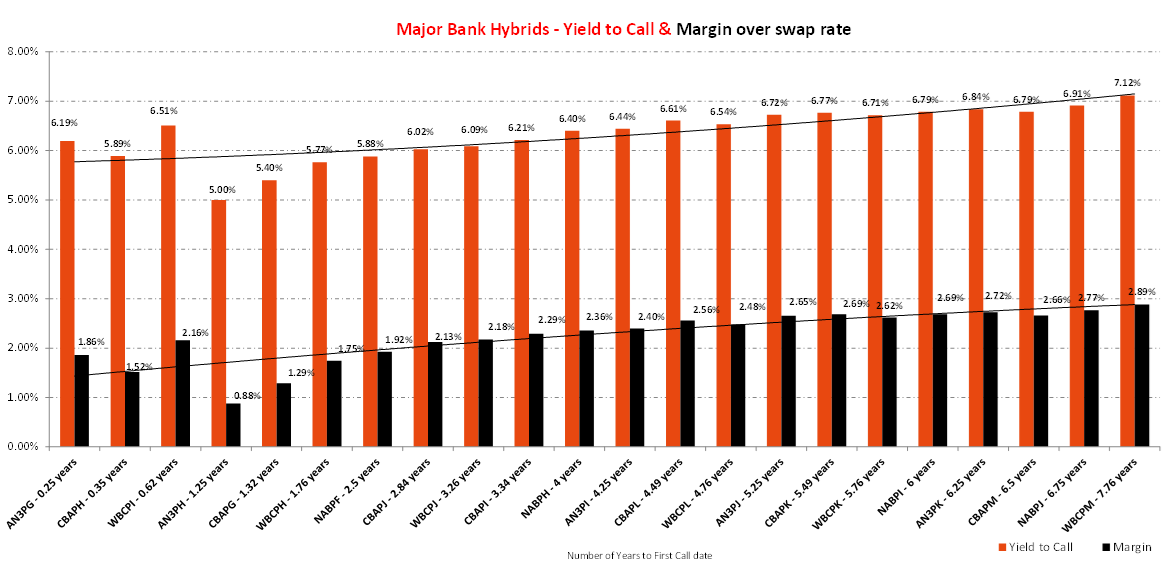

The new Westpac Hybrid Note (WBCPM) came onto the market yesterday and closed at $101.60, an excellent start to trade, which highlights how margins have moved in the past few weeks. The 10th WBC Hybrid was issued on a margin of 3.1% over the 90-day bank bill rate; however, as can be seen from the bar chart below (black bars), the prevailing spreads of existing securities are trading at margins nearer ~2.7%, meaning 1. The price of the new issue had to go up to align with the market & 2. Westpac paid slightly ‘overs’ when pricing this security, which we highlighted at the time here.

With the 90-day bank bill at 4.37%, the margin is added to that base rate to get the overall yield inclusive of franking at the time, although the chart below looks beyond 90-day bills to price in the forward curve for the duration of each note. New issues are now more challenging to get for retail investors, with a recent change in legislation meaning that only clients receiving personal advice from syndicate brokers can access them, creating more secondary market demand. There are likely to be two more new issues early next year, with ANZ likely to roll the AN3PG which has a first call date in March, while Commonwealth Bank’s CBAPG is due in April, the latter we currently hold in the Active Income Portfolio with a 5% weighting.

- We continue to like Hybrid securities for income-focused portfolios, with the Market Matters Active Income Portfolio holding an overall ~26% weighting.

Issues that look relatively attractive at today’s prices include:

- Short Dated (<3 Years): WBCPI; WBCPH

- Mid Dated (3 -5 Years): NABPH; CBAPL

- Long Dated (>5 Years): AN3PJ; AN3PK