The last hybrid we added to the portfolio was the ANZ Capital Notes 6 (ANZPI) that now has 6.6 years to run. This hybrid is paying a yield to first call of 4.36% inclusive of franking and we remain positive on this hybrid security. Yesterday, the Suncorp Capital Notes 4 (SUNPI) caught MM’s attention with a similar duration to the ANZ Hybrid, paying a yield to first call of 4.79% at current prices. We like diversification in our hybrid allocations, while we also have a preference to skew the portfolio towards major banks & insurance companies given they have strict regulatory capital requirements.

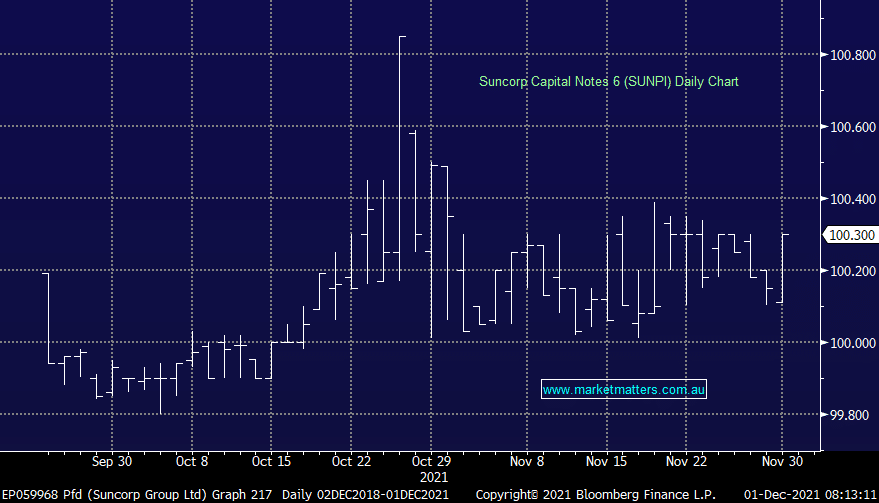

The SUNPI closed yesterday at $100.30, has a margin of ~3% over the 90 day bank bill rate equating to a grossed income of ~4.8% pa. It trades ex-distribution on the 7th December with payment on the 17th, and has 37c of accrued distribution in the price i.e. buying around here means paying less than it’s $100 issue price.